Total Amount of New After-tax Income Generated From Business Operations

Total amount of new funds the business generates from operations. The taxable income reported on.

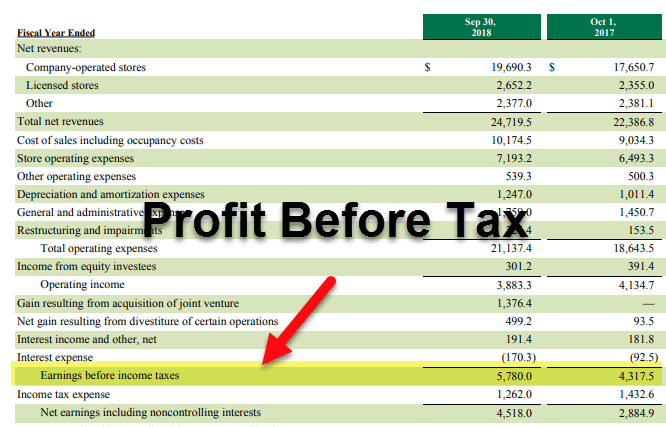

Profit Before Tax Formula Examples How To Calculate Pbt

This non-GAAP measure excludes any after-tax benefits or charges such as effects from accounting changes.

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

. 2500000 2290000 1975000 1185000. Net cash flow is the net change in the amount of cash that a business generates or loses during a reporting period and is usually measured as of the end of the last day in a reporting period. Essentially this is the amount of revenue you generated from allowed sales.

To find the net profit or net loss of your business here are a few simple steps. As such its important to calculate them carefully in order to determine your true operating revenue. 20000 net income 1000 of interest expense 21000 operating net income Calculating net income and operating net income is easy if you have good bookkeeping.

Get a refresher on income statements in our CPA-reviewed guide. Calculate Cash Flow from Operations using the Direct Method. How to Calculate Operating Income Operating income is found only by accounting for certain expenses while net income accounts for all expenses.

Cash Flow from Operations Net Income Depreciation Adjustments to Net Income Changes in Accounts Receivables Changes in Liabilities Changes in Inventories Changes in Other Operating Activities. Or Youre a patron in a specified agricultural or horticultural cooperative. Operating income Total Revenue Direct Costs Indirect Costs.

10000 50 35 Difficulty. This amount includes income not generated directly from your operations such as income from financial investments. Near the bottom of the statement highlighted in blue is Apples pre-tax income which was 259 billion for the quarter ending December 2019.

This is calculated as your sales minus your cost of goods sold. Gwen and Travis organized a new business as an LLC in which they own equal interests. Gross Profit Net Sales - Cost of Sales Net Operating Profit Gross Profit - Operating Expense Net Profit before Taxes Net Operating Profit Other Income Other Expense Net Profit or Loss Net Profit before Taxes Income Taxes Profit and Loss Report Sample.

Use the IRS formula to arrive at the tax amount for your companys income. While revenue includes the gross earning from primary operations without any deductions profit is the resultant income after accounting for expenses expenditures taxes and additional income and costs in the revenue. For example if your taxable income is 500000 you would deduct 335000 for a total of 165000.

To do so take the total amount of allowed sales and divide it by your total sales. If Jason meets the performance-based objectives and Atlas has a 21 tax rate what is Atlass after-tax cost of paying Jason. After-tax operating income ATOI is a companys total operating income after taxes.

Reported net income of 256 per share for 2021 an increase of 84 million or 11 compared to net income of 230 per share from continuing operations for 2020. Added more than 11400 natural. The income tax deduction highlighted in red shows.

The new business generated a 10000 operating loss its first year. Operating income Gross Profit Operating Expenses Depreciation Amortization. In that case you likely already have a profit and loss statement or income statement that shows your net income.

Net income before taxes Your income before taxes. After taking the companys 2 million in revenue and subtracting the 1750000 in total expenses it had over the year Company Y was left with a net income of 250000. Yes Because of the change the first return may reflect a short period of less than 12 months.

The IRC section 179 property costs may be deducted on the PA-40 Schedule C Profit Loss from Business or Profession or PA-40 Schedule E Rents and Royalty Income Loss but the total of all IRC section 179 expenses on all Pennsylvania schedules may not exceed 25000 or the applicable limit. There are three formulas to calculate income from operations. Multiply the 165000 number by the 034 tax rate for a tax amount of 170000.

Immediate expensing of the full cost of equipment bought before. The full formula of Operating Cash Flow is as follows- OCF Net Income Depreciation Stock-Based Compensation Deferred Tax Deferred Tax Deferred Tax is the effect that occurs in a firm as a result of timing differences between the date when taxes are actually paid to tax authorities by the company and the date when such tax is accrued. Operating income Total income generated from your operations after operating expenses but before interest and taxes.

The following additional information is available Cash Receipt 650000 81000 65000 634000 Cash Payment 300000 55000 42000 45000 38000 280000 Cash Expense 140000 14500 125500 Cash Taxes 40000. 5 Record the income tax that is payable to the IRS on line 31 of Form 1120. Broadest measure of profits for a firm because it includes both net income and noncash charges Horizontal Merger combination of firms producing the same kind of product.

Operating income Net Earnings Interest Expense Taxes. Sweeneys 2017 tax depreciation exceeded its book depreciation by. Subtract variable costs of goods sold VCOGS- Variable costs are those that rise.

If Gwens marginal tax rate is 35 her tax savings from the first-year LLC loss is. Jason was hired in 2019 as the new CEO and will be paid 1500000 in salary and a performance-based bonus of 1000000 upon reaching certain performance objectives. Your 2021 taxable income before your QBI deduction is more than 329800 married filing jointly 164925 for married filing separately and 164900 for all other returns.

The taxable income reported on the short-period return must be annualized - mathematically inflated to reflect 12 months of business operations. Began operations in 2017 and reported 225000 in income before income taxes for the year. The result is a net income figure that does not reflect the amount of cash actually consumed or generated in a period.

Key provisions of the Act include as described in more detail below a permanent reduction in the US federal corporate income tax rate from 35 to 21. Total income generated by a company. What is Net Cash Flow.

Profit Revenue Other income Total expenses. Reduced tax rates ranging up to 296 for many US businesses organized as partnerships limited liability companies LLCs and S corporations.

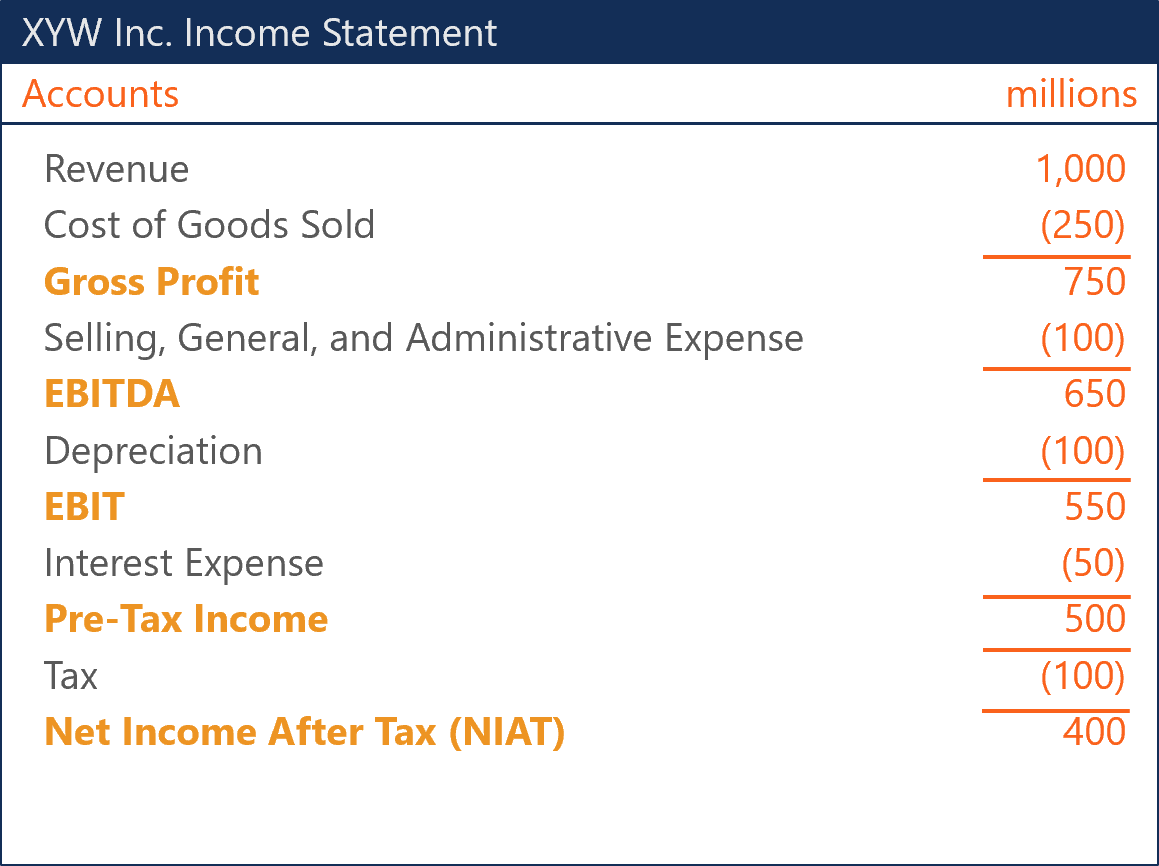

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

Net Income After Tax Niat Overview How To Calculate Analysis

No comments for "Total Amount of New After-tax Income Generated From Business Operations"

Post a Comment